Mortgage Blog

The Plus is in Our Service!

Category: Financing (21 posts)

What are credit scores and how are they important?

September 1, 2021 | Posted by: Mortgage Plus Corporation

A credit score is a number that shows how likely you are to pay or default on credit. It ranges from 300 to 850; the higher the number, the more creditworthy lenders deem you. Your credit history dete ...

read moreMulti-Family Lending: What You Need To Know About Hard Money Loans

March 8, 2021 | Posted by: Mortgage Plus Corporation

Multi-Family Lending: What You Need To Know About Hard Money Loans Multi-family real estate is one of the most popular investments for both newbie and seasoned investors. Buyers in the past used trad ...

read moreHow Good vs Bad Debt Impacts Your Household

January 27, 2021 | Posted by: Mortgage Plus Corporation

In order to understand the difference between good and bad debt, it's important to track your income and expenses and established saving goals for your family. Financial stability allows you to mee ...

read more3 Tips on How to Better Your Credit Score

December 9, 2020 | Posted by: Mortgage Plus Corporation

Having a good credit score is of paramount essence as it affects your ability to access loans and borrow money. Your credit score rating influences the amount of mortgage you qualify for. You may ...

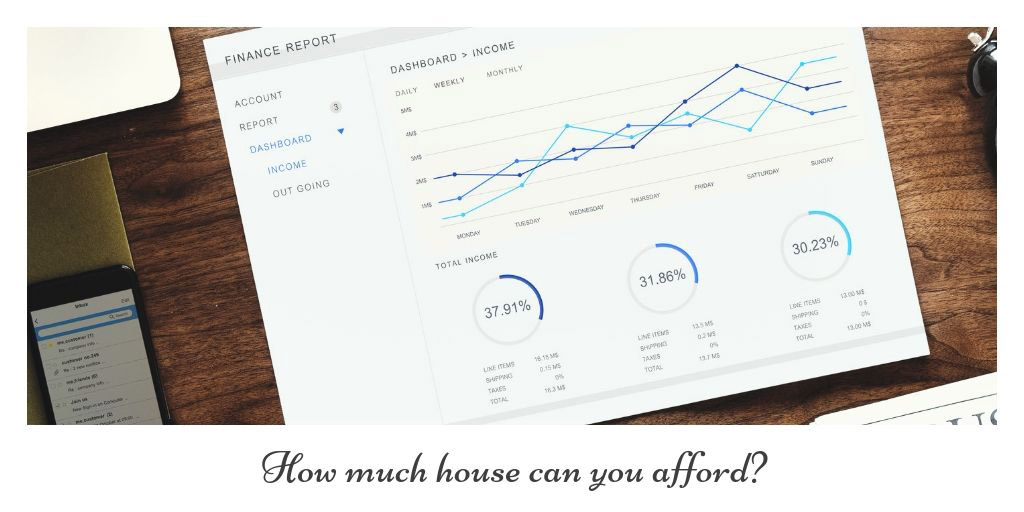

read moreHow Much House Can You Afford? Ask Yourself These Critical Questions to Find Out

April 30, 2020 | Posted by: Mortgage Plus Corporation

It is the perennial question for every first-time homeowner. How much house can I afford? As with so many life-changing decisions, there is no one right answer to this common query, and the size of th ...

read more3 Simple Ways to Repair Your Credit

April 23, 2020 | Posted by: Mortgage Plus Corporation

For many Canadians looking to purchase a home, bad credit scores stand in the way of getting a mortgage. Most lenders prefer your score to be 650 or higher. If they do allow for lower credit scores, i ...

read more3 Smart Ways to Use a Home Equity Line of Credit

February 27, 2020 | Posted by: Mortgage Plus Corporation

For homeowners across the globe, home equity lines of credit (HELOCs) have become a handy way of tapping into the value of their homes. However, when borrowing money against your home, it is always ...

read moreShould You Get a Shorter-Term Mortgage, Make Extra Payments, or Something Else?

December 12, 2019 | Posted by: Mortgage Plus Corporation

When getting a home mortgage, if you can afford higher payments, often the option of a 15-year loan instead of one of 30 years is an option. It can be an enticing idea to know that you'll be free of a ...

read moreReal Estate: How to Refinance a Mortgage with a Bad Credit Score

November 7, 2019 | Posted by: Mortgage Plus Corporation

There are many excellent reasons a homeowner may look into refinancing their mortgage. To refinance means to replace your current mortgage with a new one, almost always with a lower interest rate. For ...

read morePlanning to Refinance Your Mortgage? Ask These 4 Questions First

September 26, 2019 | Posted by: Mortgage Plus Corporation

Deciding to refinance is a crucial financial move that can help you make significant savings. When you plan properly, do your research, and take time to evaluate where you stand financially, you'll be ...

read moreHow to Maintain a Good Credit Rating Throughout the Year

September 5, 2019 | Posted by: Mortgage Plus Corporation

If you want to make it easier to get an auto loan, mortgage, or new credit card account, you need to maintain a good credit score. It's easy to do so, particularly if you follow the tips presented her ...

read moreFour Strategies That Can Help You Get Approved for a Mortgage

August 29, 2019 | Posted by: Mortgage Plus Corporation

So, you've decided to take the big step and look into getting what will likely be the biggest loan of your entire life: a mortgage. Applying for a mortgage can be a bit of a nerve-wracking process, es ...

read moreCan You Afford to Buy a New Home?

August 8, 2019 | Posted by: Mortgage Plus Corporation

Is Purchasing a New Home in Your Budget? If you're throwing your hard-earned money away on rent each month, putting that same amount towards your own home could be an incredible advantage. However, i ...

read moreCredit Card Debt vs Mortgage Debt: Which Should You Pay Off?

July 18, 2019 | Posted by: Mortgage Plus Corporation

It's always a good idea to pay down your debt when you have extra cash on hand. However, as you get started, you will probably be faced with several types of debt you can work on, and it's hard to kno ...

read moreFive Reasons Why You Should Have More Than One Bank Account

July 4, 2019 | Posted by: Mortgage Plus Corporation

In today's tech world, being victimized by hackers can leave you penniless if you have only one bank account. The following five situations demonstrate how a having a backup account can keep you ...

read more4 Reasons to Say 'Yes' to Good Credit

June 20, 2019 | Posted by: Mortgage Plus Corporation

Good credit is a necessity for acquiring many things in life. There are many important reasons for saying 'yes' to credit. Below are some of those reasons, as well as ways to get and build your credit ...

read more5 Ways to Simplify Your Financial Life

June 6, 2019 | Posted by: Mortgage Plus Corporation

No matter who you are or what you do for a living, it can seem like your bank statements, credit card receipts, and other financial documents are burying you alive. If you are struggling under the wei ...

read moreSavvy Spender: Simple, Smart Ways to Make the Most of Your Credit Cards

May 23, 2019 | Posted by: Mortgage Plus Corporation

Savvy Spender: Simple, Smart Ways to Make the Most of Your Credit Cards With their vast array of special perks and member benefits, credit cards are an appealing financing option for modern consumers ...

read moreGathering the Money for a Down Payment in Two Years or Less

May 9, 2019 | Posted by: Mortgage Plus Corporation

Whether you are looking to purchase a home in the next two years or you intend to wait another five, you must find a way to save up enough money to use for a down payment. Without the money to make a ...

read moreWhy You Need an Emergency Fund And How to Get One

April 18, 2019 | Posted by: Mortgage Plus Corporation

Building an emergency fund is something most people know they should do but few actually get around to doing. A recent study found that nearly two-thirds of Americans did not have an emergency fund, a ...

read moreStrategies to Dig Yourself Out of the Debt Hole

March 14, 2019 | Posted by: Mortgage Plus Corporation

Debt. It's something almost everyone will have at some point in their life. But what happens when your debt begins to get the better of you? What options are available? Some simple strategies can he ...

read more

.jpg)